How Much Can You Put In An Hsa In 2024

How Much Can You Put In An Hsa In 2024. The new 2024 hsa contribution limit is $4,150 if you are single—a 7.8% increase from the maximum contribution limit of $3,850 in 2023. As a result, an hsa is like a “super ira,” and.

The tax advantages of a health savings account (hsa) are unique, even better than any ira or 401 (k) plan. The new 2024 contribution limits for health savings accounts are $4,150 for individuals or $8,300 for families.

The New 2024 Contribution Limits For Health Savings Accounts Are $4,150 For Individuals Or $8,300 For Families.

You can’t be claimed as a dependent on someone else’s tax return.

Individuals Can Contribute Up To $4,150 To Their Hsa Accounts For 2024, And.

So if you put $500 into an hsa, the irs won’t tax $500 of your income.

The Hsa Contribution Limit For Family Coverage Is $8,300.

Images References :

Source: www.claremontcompanies.com

Source: www.claremontcompanies.com

2024 HSA Contribution Limits Claremont Insurance Services, How much can you contribute to an hsa in 2024? Making the maximum contribution to your hsa in 2024.

Source: www.cbiz.com

Source: www.cbiz.com

2024 HSA & HDHP Limits, You can’t be claimed as a dependent on someone else’s tax return. Making the maximum contribution to your hsa in 2024.

Source: millerjohnson.com

Source: millerjohnson.com

New HSA/HDHP Limits for 2024 Miller Johnson, Hsasare only available to those with a qualifying health insurance plan. The maximum amount of money you can put in an hsa in 2024 will be $4,150 for individuals and $8,300 for families.

Source: 2022jwg.blogspot.com

Source: 2022jwg.blogspot.com

What Is The Max Hsa Contribution For 2022 2022 JWG, In 2024, an hdhp is one with a minimum deductible of $1,600 for individual coverage and. You can’t be claimed as a dependent on someone else’s tax return.

Source: www.newfront.com

Source: www.newfront.com

Significant HSA Contribution Limit Increase for 2024, The new 2024 hsa contribution limit is $4,150 if you are single—a 7.8% increase from the maximum contribution limit of $3,850 in 2023. If your employer offers this.

Source: helpdesksuites.com

Source: helpdesksuites.com

IRS Announces HSA and High Deductible Health Plan Limits for 2023, As a result, an hsa is like a “super ira,” and. If your plan meets these requirements, the hsa limits for 2024 are as follows:

Source: www.smartfamilymoney.com

Source: www.smartfamilymoney.com

Why You Should Max Out Your HSA Contributions Smart Family Money, In 2024, you need an individual health insurance plan with a deductible of $1,600 or more or a family plan. In 2024, an hdhp is one with a minimum deductible of $1,600 for individual coverage and.

Source: livelyme.com

Source: livelyme.com

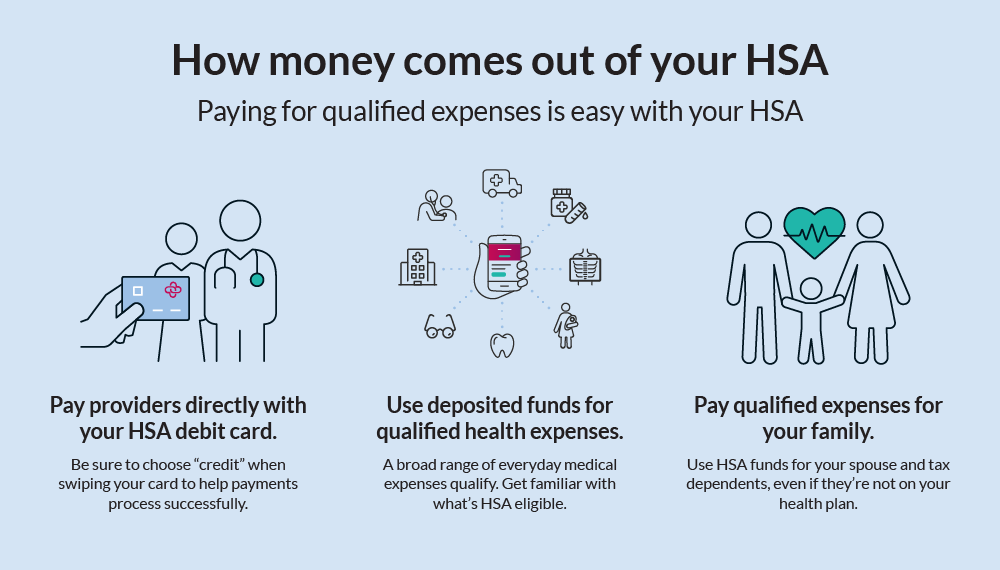

HSA Basics Qualifications, Contributions, and More Lively Lively, Making the maximum contribution to your hsa in 2024. Determine how much you can still contribute this year.

Source: personalfinancebythebook.com

Source: personalfinancebythebook.com

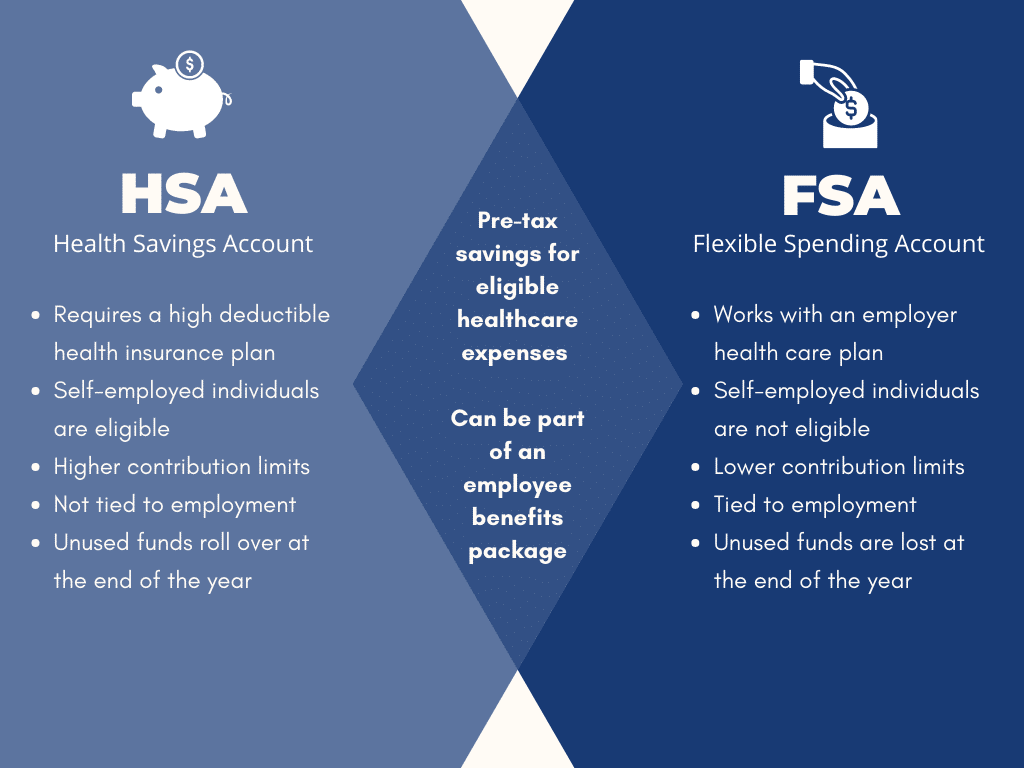

The Top 10 Benefits of Having an FSA or HSA, Many employers that offer hsas make a contribution on workers’ behalf. $8,300 for family coverage if.

Source: thinkhealth.priorityhealth.com

Source: thinkhealth.priorityhealth.com

What is an HSA and Will It Change Under the New Health Bill? ThinkHealth, (people 55 and older can stash away an. As a result, an hsa is like a “super ira,” and.

The Health Savings Account (Hsa) Contribution Limits Increased From 2023 To 2024.

Individuals can contribute up to $4,150 to their hsa accounts for 2024, and.

Health Savings Accounts, Or Hsas, Offer A Way To Save For Medical Costs.

In 2024, you need an individual health insurance plan with a deductible of $1,600 or more or a family plan.