Mileage Calculator 2025 Rate

Mileage Calculator 2025 Rate. Use the following mileage calculator to determine the travel distance, in terms of miles, and time taken by car to travel between two locations in the united. To work out how much you can claim, multiply the total business kilometres you travelled by the rate.

The calculation for cars and vans. This rate reflects the average car operating cost, including gas, maintenance, and depreciation.

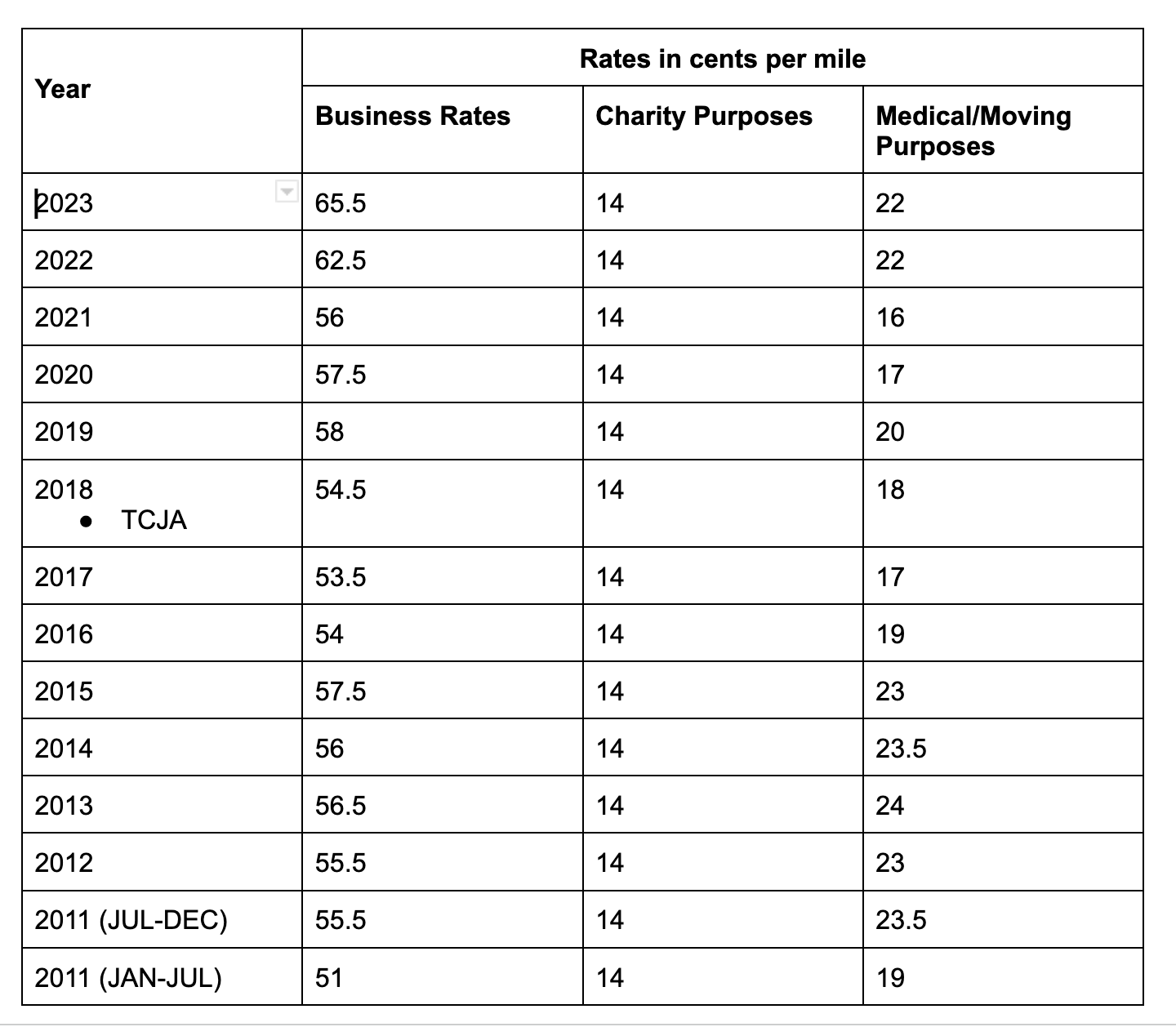

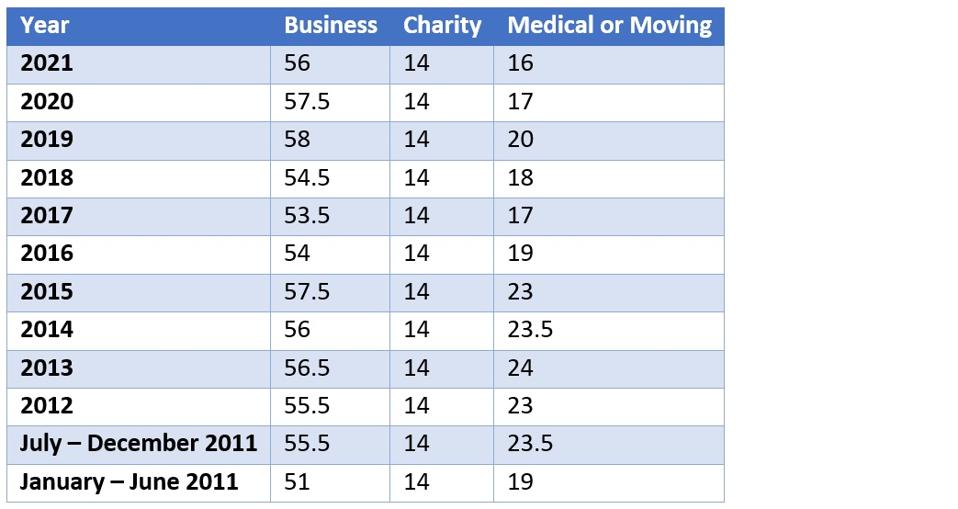

The 2025 Irs Standard Mileage Rates Are 67 Cents Per Mile For Every Business Mile Driven, 14 Cents Per Mile For Charity And 21 Cents Per Mile For Moving Or Medical.

Our 2025 mileage deduction calculator uses standard irs mileage rates to calculate your mileage deduction for taxes or reimbursement.

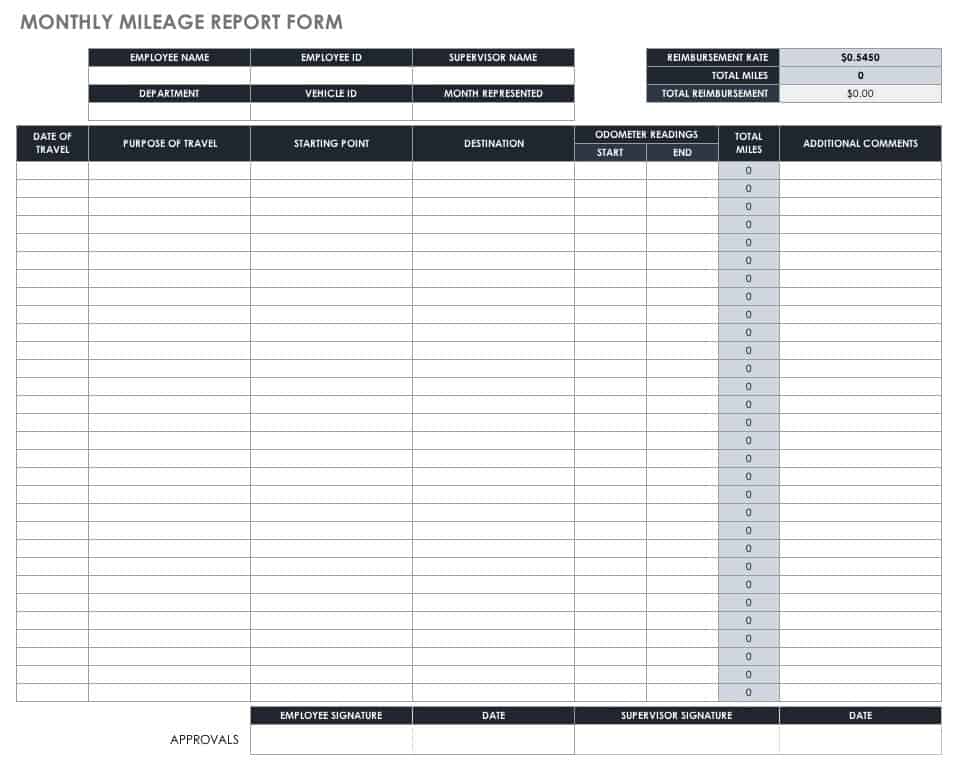

This Calculator Can Help You Track You Mileage And Can Accommodate 2 Different Rates.

The irs is raising the standard mileage rate by 1.5 cents per mile for 2025.

What Is The 2025 Federal Mileage Reimbursement Rate?

Images References :

Source: davetaqneille.pages.dev

Source: davetaqneille.pages.dev

Mileage Reimbursement 2025 Texas Gilli Klarrisa, The 2025 medical or moving rate is 21 cents per mile, down from 22 cents per mile last. The calculation for cars and vans.

Source: feodorawjeanna.pages.dev

Source: feodorawjeanna.pages.dev

Expense Rate For Mileage 2025 Bari Mariel, Many countries offer a standard mileage rate set by tax. The mileage calculator app helps you find the driving distance between cities and figure out your reimbursement using the latest irs standard mileage rate of.

Source: generateaccounting.co.nz

Source: generateaccounting.co.nz

New Mileage Rate Method Announced Generate Accounting, The vat road fuel scale charges will be updated from 1 may 2025. According to the irs, the mileage rate is set yearly “based on an annual study of the fixed and variable costs of.

Source: tamerawmame.pages.dev

Source: tamerawmame.pages.dev

Irs Mileage Rate 2025 Calculator Staci Adelind, There are generally two methods for calculating mileage allowance: Page last reviewed or updated:

Source: ireneqoralla.pages.dev

Source: ireneqoralla.pages.dev

Nc Mileage Reimbursement Rate 2025 Myrah Tiphany, Calculating mileage for business expenses. Calculate for free last updated.

Source: financiallevel.com

Source: financiallevel.com

Table showing historical IRS mileage rates, Standard medical mileage rates, parking fees, tolls, and other qualified transportation amounts can. Find standard mileage rates to calculate the deduction for using your car for business, charitable,.

Source: www.exceldemy.com

Source: www.exceldemy.com

How to Calculate Mileage in Excel (StepbyStep Guide), The medical mileage rate in the us for 2025 is 21 cents for each mile driven. 14 announced that the business standard mileage rate per mile is.

Source: www.amazon.com

Source: www.amazon.com

Mileage for Android, By inputting your tax year, miles driven for business, medical, and charity,. The calculation for cars and vans.

Source: www.youtube.com

Source: www.youtube.com

2023 IRS Standard Mileage Rate YouTube, Many countries offer a standard mileage rate set by tax. Calculate for free last updated.

Source: lichol.com

Source: lichol.com

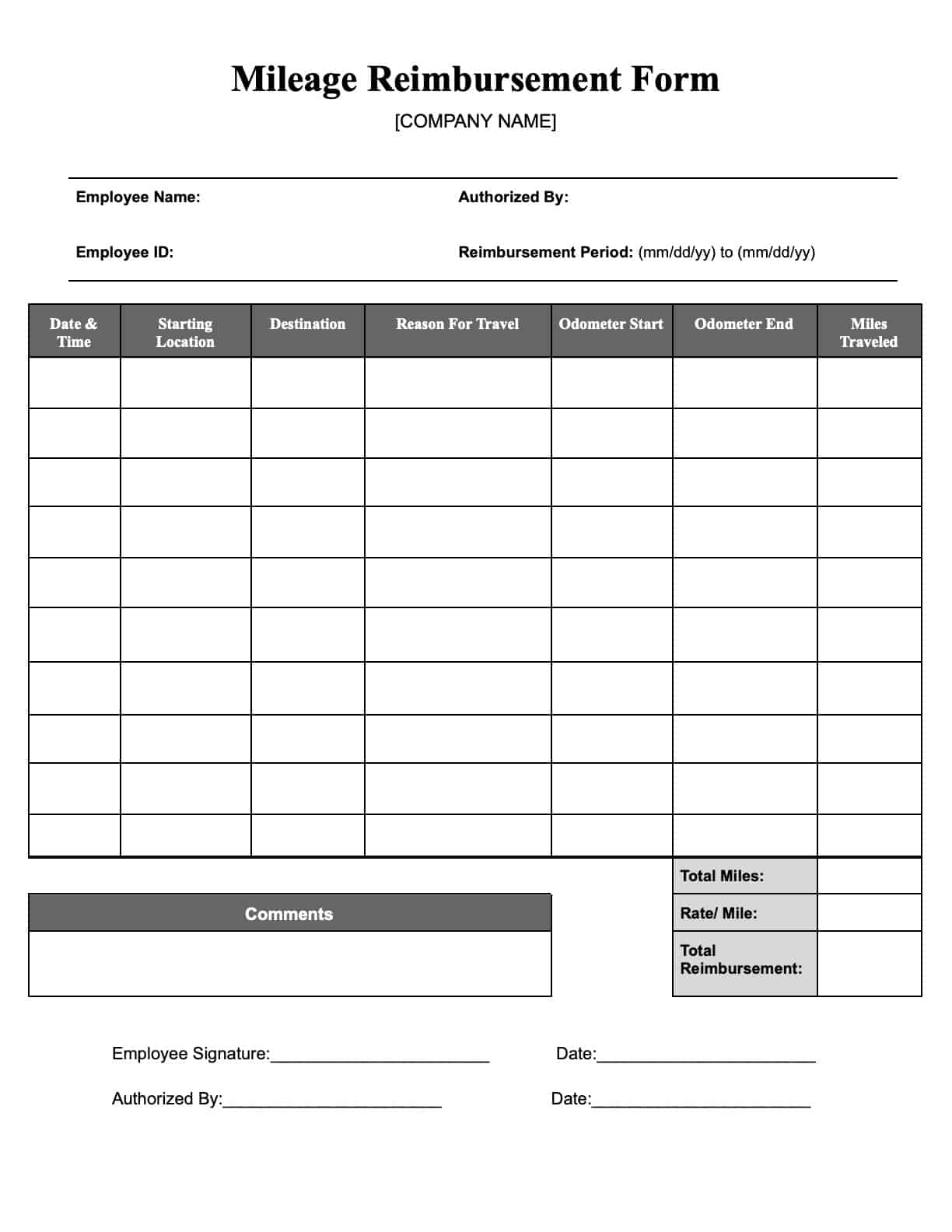

Free Mileage Log Templates Smartsheet (2023), Use the following mileage calculator to determine the travel distance, in terms of miles, and time taken by car to travel between two locations in the united. 14 announced that the business standard mileage rate per mile is.

At The End Of Last Year, The Internal Revenue Service Published The New Mileage Rates For 2025.

Calculate for free last updated.

Use The Following Mileage Calculator To Determine The Travel Distance, In Terms Of Miles, And Time Taken By Car To Travel Between Two Locations In The United.

Calculating mileage for business expenses.